If you’ve ever bought a stock, analyzed a chart, or built an investment portfolio, congratulations—you already understand the core principles of SEO. The skills that make a successful investor translate remarkably well to digital marketing, and that knowledge gap you think exists? It’s smaller than you imagine.

The Portfolio Principle: Diversification is Everything

Every smart investor knows not to put all their eggs in one basket. You spread investments across sectors, balance growth stocks with value plays, and hedge your bets. SEO works exactly the same way.

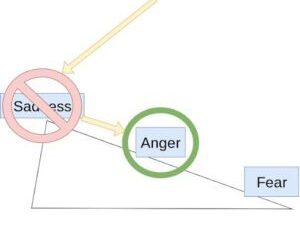

Instead of betting everything on one “money keyword” (the SEO equivalent of putting your life savings into a single penny stock), successful SEO spreads effort across multiple keyword types, each serving a different role in your strategy.

High-competition keywords are your blue-chip stocks. Think “personal injury lawyer” or “best credit cards.” These keywords are incredibly difficult to rank for because everyone wants them, just like everyone wants to own Apple or Microsoft stock. The competition is fierce, with established players dominating the top positions. But if you can break through, the traffic potential is massive. A single first-page ranking for these terms can transform a business, delivering thousands of visitors daily. Like blue-chip stocks, they require significant investment and patience, but the payoff justifies the effort.

Long-tail keywords function like steady dividend stocks. These are specific, detailed phrases like “anxiety therapy for teenage athletes in Denver” or “waterproof hiking boots for wide feet under $150.” While each individual keyword might only bring 10-50 visitors per month, they convert at much higher rates because searchers know exactly what they want. Like dividend stocks that pay you quarterly regardless of market conditions, long-tail keywords provide reliable, consistent traffic. Better yet, you can rank for hundreds of them with far less effort than chasing one competitive term.

Local search terms are the municipal bonds of SEO. Searches like “dentist near me” or “Chicago pizza delivery” might not sound exciting, but they’re incredibly stable and virtually recession-proof. People will always need local services, just as municipalities will always need funding. These keywords often convert at the highest rates because they capture people ready to buy, not just browsing. Plus, the competition is limited to your geographic area, not the entire internet. Like munis offering tax advantages, local SEO offers unique benefits through Google My Business and map pack rankings that national competitors can’t access.

Emerging topics represent your growth stocks. Remember when nobody was searching for “cryptocurrency wallet” or “air fryer recipes”? Early adopters who created content for these terms before they exploded reaped massive rewards. These are the small-cap stocks of SEO, topics that might seem niche today but could become mainstream tomorrow. Maybe it’s a new therapy technique, an emerging technology, or a cultural trend just starting to gain traction. The risk is that some won’t pan out, but the ones that do can deliver 10x or 100x returns on your effort.

Just as financial advisors build balanced portfolios, whether you’re optimizing for “cognitive behavioral therapy” or “SEO for therapists“, the principle remains: spread your risk across all four categories to maximize your opportunities while protecting against algorithm changes or competitive threats.

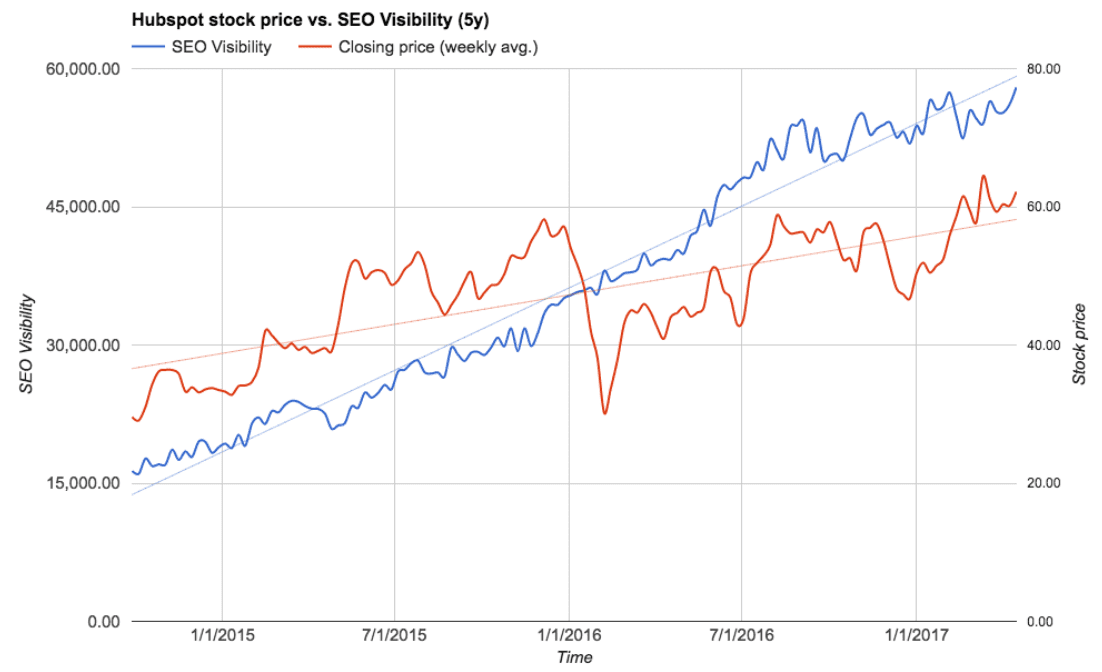

Reading the Charts: Technical Analysis for Rankings

Stock traders live and die by their charts—moving averages, support levels, resistance points. SEO has its own technical indicators that tell remarkably similar stories:

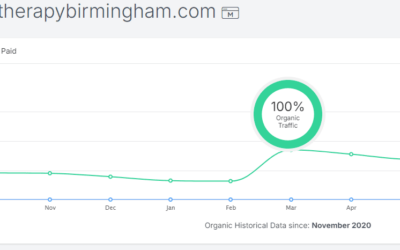

Moving Averages = Ranking Trends That 50-day moving average you track for stocks? In SEO, we track 30-day ranking averages. A keyword climbing above its historical average signals momentum, just like a stock breaking above its MA.

Support and Resistance = Ranking Floors and Ceilings Notice how your site seems stuck at position 11 for certain keywords? That’s your resistance level. Just like stocks bounce off support at $50, websites often have ranking floors where they consistently bottom out before recovering.

Volume Analysis = Search Volume Trends Trading volume confirms price movements. Search volume confirms keyword value. A keyword with increasing search volume is like a stock with increasing trading interest—it signals opportunity.

Fundamental Analysis: Due Diligence Pays Off

Before buying a stock, you analyze the company’s fundamentals—revenue, growth rate, competitive moat. SEO requires the same investigative rigor:

P/E Ratio = Keyword Difficulty Score A stock’s P/E ratio tells you if it’s overvalued. A keyword’s difficulty score tells you if it’s worth targeting. High difficulty with low search volume? That’s like buying a stock with a P/E of 100—probably not worth it.

Earnings Reports = Analytics Reviews Quarterly earnings calls keep investors informed. Monthly analytics reviews keep SEO on track. Both reveal whether your strategies are working or need adjustment.

Market Cap = Domain Authority Large-cap stocks are stable but grow slowly. High domain authority sites rank easily but need massive effort to improve further. Small-cap stocks are volatile but offer growth potential. New websites are harder to rank but can see explosive growth with the right strategy.

Risk Management: Stop-Losses and Pivot Points

Smart traders set stop-losses to limit downside. Smart SEO practitioners have exit strategies too:

- If a keyword hasn’t moved after 6 months of effort, pivot (your stop-loss triggered)

- If Google updates tank your traffic, have backup traffic sources ready (hedge your position)

- Monitor competitor movements like you’d watch institutional investors (whale watching)

The Compound Effect: Reinvesting Dividends

When stocks pay dividends, smart investors reinvest them for compound growth. SEO has its own compound effect:

Every piece of content that ranks becomes a dividend-paying asset. It brings in traffic, which you can “reinvest” by:

- Creating related content (reinvesting dividends)

- Building internal links (compounding returns)

- Updating and expanding successful pages (dividend growth investing)

A single well-ranking article about “anxiety therapy techniques” can spawn ten related articles, each feeding traffic to the others—compound growth in action.

Market Timing vs. Time in Market

“Time in the market beats timing the market”—every investor knows this wisdom. SEO follows the same principle. While competitors chase algorithm updates and trendy tactics (day trading), consistent, long-term SEO strategies (buy and hold) almost always win.

Building authoritative content, earning quality backlinks, and improving user experience are the SEO equivalent of dollar-cost averaging into index funds. Boring? Perhaps. Effective? Absolutely.

The Information Advantage

In stocks, insider information is illegal. In SEO, competitive intelligence is essential. Tools like SEMrush and Ahrefs are your Bloomberg Terminal, revealing:

- What keywords competitors rank for (their portfolio holdings)

- Which content drives their traffic (their best performing assets)

- Where their backlinks come from (their funding sources)

This information asymmetry is legal and powerful—use it.

Your Transferable Skills Checklist

If you can trade stocks, you can do SEO because you already understand:

✓ Risk/reward analysis – Evaluating whether effort matches potential return

✓ Trend identification – Spotting patterns before they become obvious

✓ Patience and discipline – Not chasing every shiny object

✓ Data interpretation – Reading charts and making informed decisions

✓ Portfolio management – Balancing multiple assets/keywords

✓ Market research – Understanding competitive landscapes

✓ Long-term thinking – Building wealth/traffic over time

The Bottom Line

The same analytical mindset that helps you evaluate a stock’s potential helps you identify valuable keywords. The patience required to hold through market volatility translates to weathering Google updates. The discipline to follow your investment strategy despite FOMO works equally well when everyone’s chasing the latest SEO hack.

Whether you’re optimizing a therapy practice website or building an online empire, the principles remain constant: research thoroughly, diversify wisely, monitor consistently, and think long-term.

Your investing knowledge isn’t just relevant to SEO—it’s a competitive advantage. While others learn SEO from scratch, you’re simply applying proven financial principles to a new market.

The question isn’t whether you can learn SEO. It’s how quickly you can apply what you already know.

Ready to put your analytical skills to work? Start with specialized markets where expertise matters most. Learn how targeted strategies work in practice with our guide to SEO for therapists, where the same portfolio principles help mental health professionals reach clients who need them most.

0 Comments