Rethinking Money, Gold, and Value: A Thought Experiment on Alternative Economic Systems

What do we truly value as a society? This profound question strikes at the heart of how we structure our communities, economies, and ways of life. In this thought-provoking article, we’ll embark on a fascinating thought experiment to reexamine our unconscious assumptions about money, gold, debt, and worth. By challenging the status quo and exploring alternative economic models, we may gain fresh insights into creating a more equitable, sustainable, and fulfilling world.

Disclaimer: This piece is a thought experiment designed to stimulate reflection and reconsideration of societal norms and conceptions. The ideas explored here do not advocate for any specific political or economic changes but rather encourage readers to think critically about the foundations of our current systems. As a psychotherapist, not an economist or theologian, I approach this topic from a psychological and philosophical perspective.

Imagining a World Without Gold: The Yap Case Study

First, let’s imagine a hypothetical world without precious, non-perishable metals like gold, silver, and platinum. In this scenario, what would serve as the basis for money and value storage? To explore potential answers, we can look to the thought-provoking real-world example of the remote Pacific island of Yap.

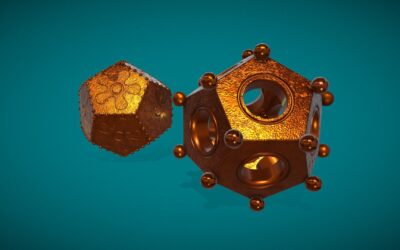

On Yap, massive limestone discs called rai stones, some towering at 12 feet tall and weighing over 8,000 pounds, functioned as a form of currency. Remarkably, the Yapese never physically moved these cumbersome stones to complete transactions. Instead, they maintained a collective oral ledger of who owned which stones at any given time. Ownership could be transferred without the stones ever changing location, functioning like an ancient predecessor to modern digital banking.

The acquisition and allotment of rai stones on Yap were inextricably linked to social merit and status. Individuals earned stones through contributions and accomplishments that benefited the community as a whole, such as heroic acts, successful leadership, innovation, and exceptional artisanship. The community collectively determined and reached consensus on each person’s social merit.

Notably, rai stones weren’t meant to be hoarded for individual gain but rather signified one’s standing and prestige in society. Those with the most stones were respected and admired for what they had given to support the common good. In effect, the rai stones made social value tangible and quantified esteem, creating an economy that prioritized and incentivized contributing to collective wellbeing.

While the Yapese system is a specific cultural example, it provides a compelling thought experiment for how a society could conceivably store and measure value without relying on precious metals. By tying value to reputation, generosity, and making a positive impact, it presents an intriguing alternative to our current paradigms.

The Impact of Gold on Society and Power Dynamics

Of course, in reality, gold and other precious metals have played a pivotal role in shaping human civilizations. It’s fascinating to consider the cosmic rarity and happenstance of gold’s existence on Earth, resulting from cataclysmic stellar explosions billions of years ago. The symbolism of gold has taken on mythical proportions, often relating to the archetype of the Self in Jungian analysis of our unconscious psyches.

When gold emerged as a de facto currency in ancient Lydia around 600 BCE, it was largely due to its unique physical properties. Over time, gold became inextricably linked to money and economic power. But what other paths could we have gone down? What if, rather than latching onto gold as the universal equivalent and basis for money, we had continued to tie value to social reputation and merit as in the Yap thought experiment?

Contrasting Communal and Competition-Based Economies

In preindustrial, communal gift economies and barter-based societies, resources tended to be more evenly distributed, and generosity was prized. Social reputation acted as a form of safety net and insurance. Prestige went to those who gave the most to support others, not to those who hoarded material wealth for themselves.

In contrast, the non-perishable nature of precious metal-backed money incentivized and enabled the accumulation of wealth and power in the hands of a few. Because metals could be hoarded indefinitely without losing value, they facilitated the concentration of riches, creating self-perpetuating imbalances. Metal-based economies incentivized individualism and looking out for oneself over the collective good.

Rethinking Value in Light of the Yap Example

So what can we learn from this thought experiment and the contrasting Yap example? At the very least, it reveals that our current paradigms are not inevitable or the only possibilities. We have a choice in what we deem valuable and center our societies around.

Even as we’ve moved towards fiat currencies and digital money, our underlying conceptions of worth are still heavily tied to notions we ascribe to gold – scarcity, accumulation, and arbitrary value not tied to utility or social good. Perhaps it’s time we critically reexamine these paradigms and dare to imagine alternatives more aligned with our values and wellbeing.

What would it look like to have an economic system that actively incentivizes and rewards contributing to the greater good, as the Yap case study suggests? How would it change our social fabric if reputation, impact, and generosity were the most valuable assets one could attain? While there are certainly challenges in restructuring our fundamental systems, envisioning a world where the love of money and hoarding wealth are not the root of so much strife and inequality is a worthy undertaking.

Exploring scenarios like the Yap example can help jolt us out of complacency and open up new possibilities. In the end, where we choose to ascribe worth and direct our energy may just make all the difference. The future is ours to shape through our collective choices and creativity, guided by a clear vision of the values we wish to uphold.

References:

Fitzpatrick, S. (2018). Yap stones and the economics of traditional money. In The Construction of Value in the Ancient World (pp. 261-284). Cotsen Institute of Archaeology Press.

Graeber, D. (2011). Debt: The first 5,000 years. Melville House.

Hyde, L. (2007). The gift: Creativity and the artist in the modern world. Vintage.

Lietaer, B., & Dunne, J. (2013). Rethinking money: How new currencies turn scarcity into prosperity. Berrett-Koehler Publishers.

Mauss, M. (2002). The gift: The form and reason for exchange in archaic societies. Routledge.

Von Reden, S. (1997). Money, law and exchange: coinage in the Greek polis. The Journal of Hellenic Studies, 117, 154-176.

Wray, L. R. (Ed.). (2004). Credit and state theories of money: the contributions of A. Mitchell Innes. Edward Elgar Publishing.

Further Reading:

Eisenstein, C. (2011). Sacred economics: Money, gift, and society in the age of transition. North Atlantic Books.

Graeber, D. (2001). Toward an anthropological theory of value: The false coin of our own dreams. Palgrave Macmillan.

Hallsmith, G., & Lietaer, B. (2011). Creating wealth: Growing local economies with local currencies. New Society Publishers.

Jevons, W. S. (1875). Money and the mechanism of exchange. D. Appleton.

Keynes, J. M. (1930). A treatise on money: in 2 volumes. Macmillan & Company.

Polanyi, K. (1944). The great transformation: The political and economic origins of our time. Beacon Press.

Simmel, G. (2004). The philosophy of money. Routledge.

Weatherford, J. (1997). The history of money. Crown Publishers.

Zelizer, V. A. (1994). The social meaning of money. Basic Books.

Zohary, D., Hopf, M., & Weiss, E. (2012). Domestication of plants in the Old World: The origin and spread of domesticated plants in Southwest Asia, Europe, and the Mediterranean Basin. Oxford University Press.

0 Comments